Something Has Gone Horribly, Terribly Wrong With E-Commerce

We've entered the Gen-Z Subsidized Social Commerce Era

I don’t know where to shop anymore. Do you? Coming from someone that could be considered a shopping addict (though I prefer connoisseur), this is particularly notable. Something has gone terribly, inexplicably wrong with e-commerce.

Luxury e-commerce platforms are falling like dominos, while chaotic social commerce platforms like Temu and TikTok Shop are taking off with endless products but limited sense or style. Out of necessity, consumers are turning to Substack for shopping guidance and curation that is hard to come by these days.

Nearly three decades separate the launch of the fashion and luxury e-commerce space with the founding of Net-a-Porter in 2000, and Temu’s recent “Shop Like a Billionaire” Super Bowl ad in 2024. This progress (though, frankly, I hesitate to call it such) has seemingly been swallowed up by a massive black hole recently— leaving only confusion, unpaid inventory, and a lingering sense of desperation.

The luxury e-commerce market is in disarray. The social commerce space feels like SoHo during New York Fashion Week — chaotic, overwhelming, and full of “influencers”. The middle market? I’m not sure it even exists anymore.

The entire space is shifting before our eyes — but why? And what’s next?

Luxury E-Commerce is Having a Terrible, Horrible, No Good, Very Bad [Year]

I hope I’m not the only one that read this book as a child.

Like an avalanche, the headlines have come one after another:

Matchesfashion went into administration just four months after being acquired by Fraser Group.

Farfetch was bought out by South Korean Coupang in a $500M fire sale, a steep drop from its $23B peak valuation in 2021. (Fun fact: I purchased Farfetch stock in November 2021 and rode that baby right down until it got delisted. Don’t come to me for public market advice.)

Net-a-Porter is desperately seeking a buyer after a deal to sell a 47% stake to Farfetch fell through, for, well… obvious reasons.

It’s like watching a multi-car pileup on the highway. You’re not sure how it started, but it has taken out multiple lanes and you’re just grateful to have dodged it. Yet the question remains — what went wrong? Is the luxury market to blame, or was there a fundamental flaw in these business models? This warrants some thought as a new wave of e-commerce players will have to contend with the same issues.

It Doesn’t Appear to Be a Demand Problem

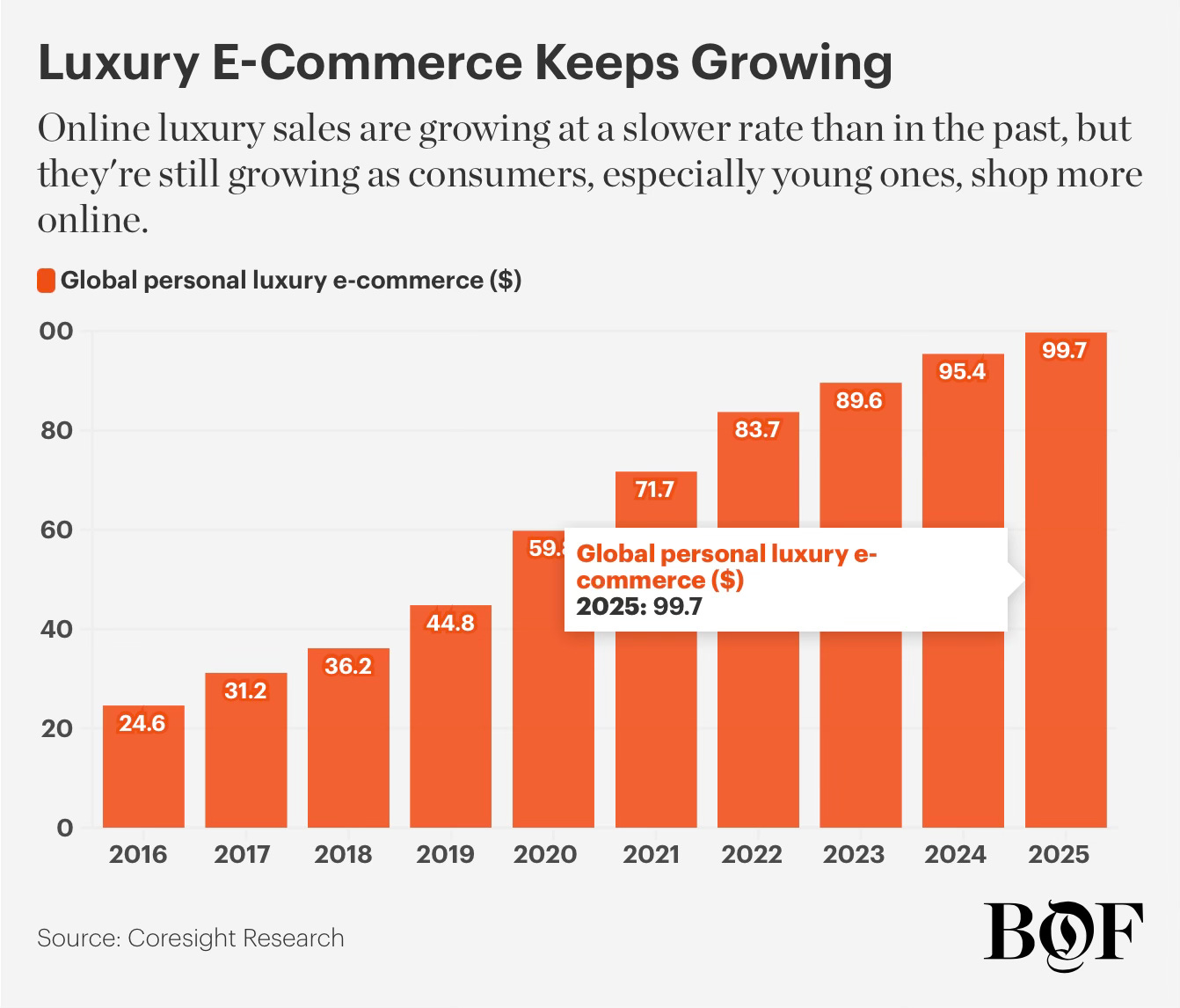

At least, not according to the Business of Fashion, who reports that luxury sales are higher than ever — and continuing to climb. A positive for the space, but even more confounding for the poor souls we’ve lost recently (RIP).

Caught in a Bad Romance Business

When you can’t blame the market, you have to blame the business [model]. And it seems Michael Morton agrees. On a recent Stratechery interview, he suggested that Covid simply accelerated the inevitable, by overwhelming these e-commerce businesses and thus exposing the cracks within. While I don’t agree with much of his remaining analysis in that interview, that particular point is well-founded.

While I obviously don’t have completely transparent insight into these businesses, a few reasons I believe these businesses ultimately failed are:

Once Innovative, Now a Commodity

When Net-a-Porter first launched, selling luxury online was truly groundbreaking. Inevitably, however, it too succumbed to Porter’s Five Forces as competitors entered the space and what was once an innovation became a commodity. Fatefully, none of these businesses tailored their response — they all had the same site design, similar merchandising, and identical consumer experiences. A differentiated product is Business 101, my friends.

MyTheresa is the perfect counterpoint. A luxury e-commerce business that has not just survived, but is in fact profitable. Italics warranted. They differentiated by curating ultra high-fashion items and catering almost exclusively to ultra-high net worth clients — following the 80/20 rule perfectly (though in this case it might even be 90/10). A singular focus on the ‘right’ customer has allowed MyTheresa to succeed where others have failed, as the CEO Michael Kliger explains in this excellent deep-dive.

2. Are You a Tech Company, or a Retailer?

Reminiscent of how WeWork infamously claimed to be a 'community company' in its 2019 S1, Farfetch and Net-a-Porter have long branded themselves as tech companies. In many ways, they are—except for their little inventory issue. Farfetch originally thrived as a SaaS business connecting boutiques to consumers, a drop-shipping model with great margins. But then, they started acquiring businesses with inventory, moving away from their asset-light model towards something much heavier—despite investor pleas against it (or so I’ve been told).

These were always wholesale retail businesses (with the slim margins and complexities that accompany them) masquerading as software businesses (with the public market multiples that accompany those). Inevitably, something had to give.

3. You Can’t Acquire Profitability (No Matter How Hard You Try)

With mounting losses, Farfetch and others tried the universally bad idea of ‘acquiring profitability’ with the likes of Stadium Goods and Browns. At the time of acquisition, they argued these acquisitions would ‘improve their brand portfolio’ and ‘blend the physical and digital worlds’. José, if you’re reading this — boy, do I have a solution for you.

While they didn’t manage to acquire profitability, they did acquire a heavy brick-and-mortar footprint, excessive amounts of inventory, and all the headaches those come with. Buyers beware — turns out clichés are clichés for a reason.

4. It’s Damn Expensive to Acquire New Customers

Who knew? Oh, just every consumer brand ever. CAC has increased 222% over the last eight years. Turns out it’s just really hard to get new customers (which is why focusing on the *right* customers, à la MyTheresa, is more important than ever). If you can’t figure out your unit economics here, you’re screwed.

There are certainly more contributing factors than those I have listed here, including misallocation of resources, plain old bureaucracy, a failure to innovate and the like. However, the fact remains that the death of these businesses have left a white space in the market, which will ideally give rise to a new generation of e-commerce platforms that, and I say this with the utmost importance, look nothing like those of the past.

We’re seeing the first stab at a new era of commerce: the “everything” social commerce platform. But it too, comes with its (many) faults.

From DTC to Distribution (And Back Again)

One of my favourite trends to watch play out in the commerce space is the inevitable swing between “We don’t need middlemen! We’ll go directly to the consumer and cut costs!” To “Oh god, acquiring consumers is hard, we need distribution.” It’s like watching the ball fly back and forth in a Djokovic-Alcaraz masters final (that Djokovic obviously wins in the end).

Luxury brands are currently entering the latter phase. As luxury platforms fall, these brands believe its their chance to build up their websites and own the consumer experience. They forget, at their own peril, that this is not how consumers like to shop. Like Pharrell says, the ultimate luxury is convenience.

Ironically, middle-market brands are desperate for distribution, and thus turning to multi-brand retailers like Sephora, and social commerce platforms. Oh, the irony.

This Social Commerce Era is Cute, But It Won’t Last

Temu’s ‘Shop Like a Billionaire” ad takes on a comedic feel when you realize most items on the platform cost around $3. What is in the billions, however, is their marketing spend. And it seems to be working (for now).

Social commerce is (finally) gaining a footing in the U.S. (after two decades of success in China) with the likes of Temu and TikTok Shop, who sell shockingly cheap products to equally surprisingly well-off buyers (I’m talking an average income of $130K+).

As luxury e-commerce stumbles, why are Temu and TikTok on the rise? This time, it is a mix of market and business strategy:

The Market Tailwind: Gen-Z Wants Social Commerce

I’ve said it once and I’ll say it again - Gen-Z wants to *buy* fashion and beauty products where they are *already* discovering fashion & beauty products — on social commerce platforms, influenced by their friends and peers. This tailwind is contributing to the rise of this trend, but Temu and TikTok also have some specific tricks up their sleeves — specifically, just outspending everyone else.

The Business Strategy: Outspend You, and Outsubsidize You

Outspend You: As per this Sarah Tavel tweet, TikTok dropped a cool $1B on acquiring customers in the U.S. Temu is taking this to new heights, on track to spend $3B on marketing this year alone. With customer acquisition costs already sky-high, these figures are eye-watering.

Outsubsidize You: Both TikTok and Temu aren't just splurging on ads; they're practically giving money away. TikTok, for example, offers new merchants $1,000 in ad credits to kickstart sales. TikTok is also heavily subsidize products on Shop, with some items offered for 60% off.

Need I remind everyone when the Millennial Lifestyle Subsidy era came to an end and businesses like Uber, DoorDash, and the rest became less… Subsidized. When VC money runs out (and it always does), prices jump and users jump off. This model wasn’t built to last.

Similarly, I’m certain the Gen-Z Social Commerce Subsidy era will come to an end for the following reasons:

This Spending is Unsustainable: This feels like enough said. Even the deepest of wells will eventually run dry.

The Amazon Dilemma: This is one of my main theses about this space. I named it for Amazon’s long attempt (and failure) to capture high-fashion brands for the simple reason that fashion brands care about their… brand. Shocker.

The Amazon Dilemma is thus the inability for platforms who start by selling cheap products to move upmarket. It is much easier to move downmarket (more expensive to less expensive) that the contrary.

With brands wary of cheapening their image, TikTok and Temu might hit similar roadblocks as they try to upscale from bargain basement deals. We will have some data on this shortly though, it seems, as within the past six months TikTok has launched luxury resale in both their US and UK markets. While I don’t believe secondary sales to be the perfect proxy, it will be a good indicator of consumer sentiment around willingness to buy on these platforms.Just the Wrong Approach: I would apologize for this being an Aleksija-coded take, but this letter is explicitly my own opinion. With that in mind, I believe TikTok is taking the entirely wrong approach. They are, similar to other e-commerce platforms, stubbornly sticking to a centralized, one-size-fits-all marketplace, herding users to an owned Shop tab with little curation and lots of cheap products.

Yet they are completely missing their singular superpower — their creators. At the risk of repeating myself for the Nth time, TikTok should allow each and every creator to permissionless-ly creator their own shop with products from the marketplace.

They say insanity is doing the same action repeatedly and expecting different results. Some might argue that is what is happening in e-commerce — everyone trying the same model and failing. Others could argue this is exactly what I am doing writing about peer-to-peer commerce. To each their own insanity.TikTok Might Just Shut Down All Together: The potential TikTok ban has been signed into law, so if it doesn’t sell (or even if it does), my previous commentary will be rendered fairly irrelevant anyways.

I Am Once Again Making the Argument for a New Era of Commerce

I have almost completed by transformation into this Bernie meme. I will not bore you with another tirade — I think we all know what I think commerce should look like. I’ve outlined it here, here and here. The real moral of the story, and the reason I’ve written this piece, is to drive home the fact that what is happening right now is not it. Time to imagine a new future and exit the Gen-Z Subsidized Social Commerce Era.

great read & insights, thank you! would also callout ssense as a differentiated luxury platform